Send a message.

We’re here to answer any question you may have.

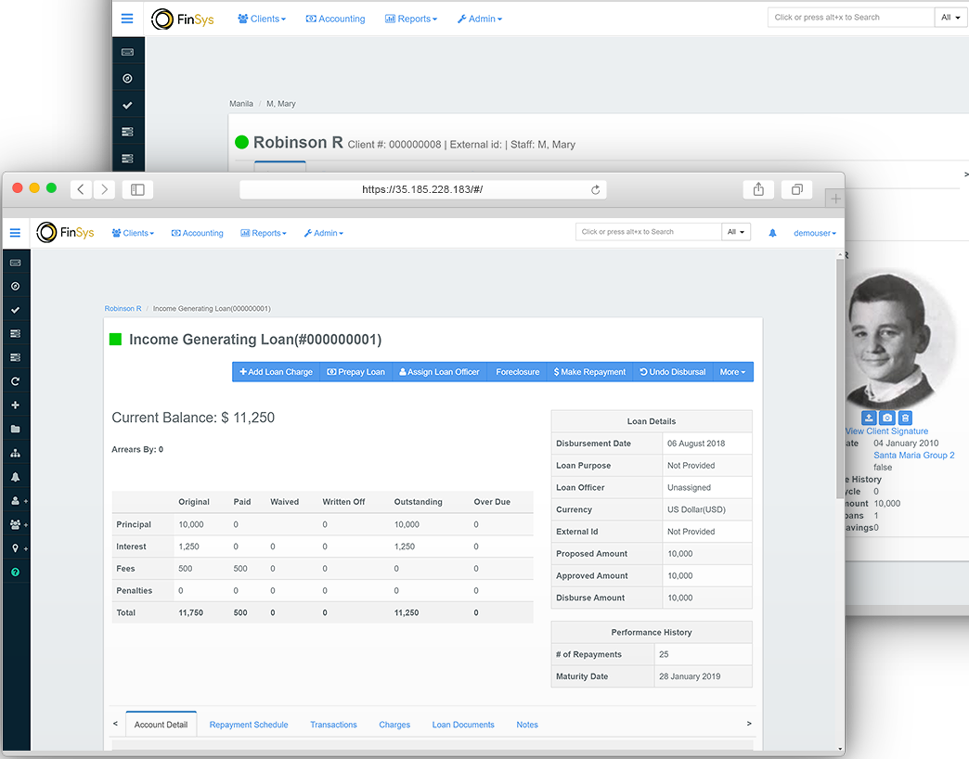

FinSys is a robust, secure, scalable and cost

effective digital, cloud-enabled banking platform,

built on Apache Fineract core and optimized for

digital and mass market banking.

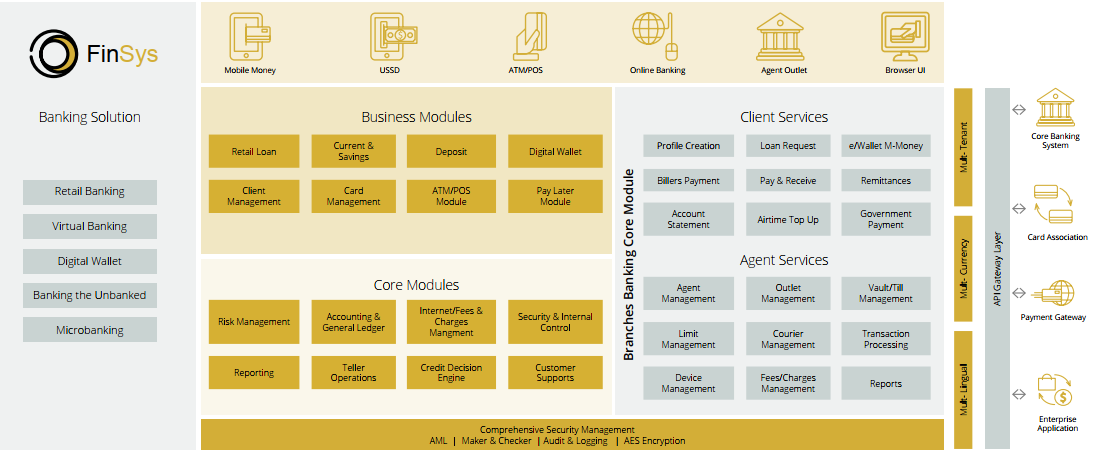

FinSys is built on modular and service-oriented

architecture, It provides a comprehensive range of

functionalities and capabilities required to deliver a

full-range of banking services for the retail, digital,

micro and branchless banking operating model.

FinSys helps both the traditional, neobank and challenger

banks to deliver a technology driven innovative

operating model in the most cost-effective manner.

The system provides a comprehensive range of functionalities

required to deliver financial inclusion for the low income segment. This allows financial institutions,

Telco’s, Fintech companies rollout financial services

in the most cost-effective way.

FinSys Banking System

supports multi-entity, multi-currency and multilingual capabilities. It has a complete range of

independent business modules which operate

within an integrated framework.

FinSys supports lending, investment account with

support for fixed and recurring deposits, savings

and current accounts, standing instructions,

account transfers and also support a mix

of deposit and credit products. Flexible interest,

charges and fees management.

FinSys provides a comprehensive agency banking

modules with functionalities that include multi-tiered KYC, agent management, customer

management,charges, fees and commission

management with support for Grameen loan,

Group savings, P2P, P2B transfer, bill payment,

government grants payment, e-wallet account etc.

As digital economy dawn on us, let’s walk with you on the onerous journey of transforming your business.