Send a message.

We’re here to answer any question you may have.

We’re here to answer any question you may have.

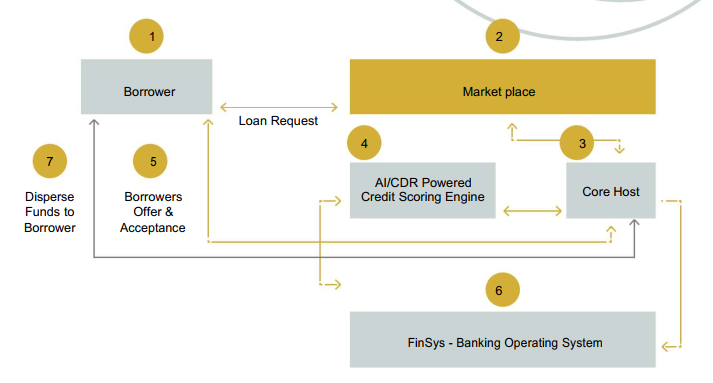

Finsys Digital Lending Platform is a multi-sided platform which provides the capabilities for an end-to-end loan origination, credit assessment, loan processing, disbursement and managing the entire lifecycle of a loan contract. The platform provides full support for loan application via digital channels like USSD, Mobile App and Web portal. Other functionalities includes e-KYC, profile management, loan product search, borrowers eligibility check, AI-powered decision engine, real time loan approval or decline.

The FinSys-DLP provides multi-purpose capabilities which help streamline and improve the efficiency of borrowers’ onboarding and profile management. This provides an enhanced user experience and transaction visibility throughout the lifecycle of the loan contract. It also help reduce the loan administration cost to the barest minimum

Lenders are able to increase their profit margin by cutting out the upfront sunk cost of technology infrastructure required to run digital lending. In addition, the platform will increase the volume of loan origination for the lenders. In other words, a lender that normally handles about 5,000 applications monthly will be able to do 50,000 or more applications every month

The FinSys-DLP platform allows the lenders to increase the volume of loan application by 100 folds. It could potentially minimize the number of loan defaults due to the use of AI-credit decision engine which helps filter out loan applications and customers with propensity for default

The FinSys DLP platform is provided in a SaaS model, this ensures that there is minimal upfront technology cost for the lender. Lenders are able to focus on their primary business of lending while OpenFactor focuses on providing and supporting the platform 24 X 7 on an ongoing basis

As digital economy dawn on us, let’s walk with you on the onerous journey of transforming your business.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Adding {{itemName}} to cart

Added {{itemName}} to cart